Company car & benefits values

Change to a more luxurious car and eliminate preferential taxation altogether!

Do you think tax board benefits values are too high or that it disadvantages interesting car types? -Then this one is for you.

In Estonia company cars don´t benefits values, regardless of the car type. By letting your Estonian company own and pay for the car, you can now completely avoid preferential taxation on the car.

Company car in Estonia

As an EU citizen you have the right to drive an EU-registered car in all Member States. Because the car is owned and registered in Estonia, the estonian tax rules applies for the car. Estonia does not have company cars benefit value and the owner of the car (the company) pays instead a special car fee in tax, this fee is 217 EUR per month and car.

NB! The car fee is fixed and is not dependent on the car's purchase price, brand, model, or value.

Estonian car

You have basically three options when it comes to buying a car for your Estonian company: buying a new car, directly in Estonia, with EU warranty. Buy a used car, directly in Estonia. Exporting a car from abroad to Estonia and re-register the car in Estonia. In Tallinn there are a number of car dealers that sells new or nearly new cars in the higher price classes. The web page www.auto24.ee exposes various car traders variety.

VAT and financing

If you choose to buy or lease the car in Estonia you can deduct all the VAT (in Estonia is VAT 20%).

There are two ways to lease cars in Estonia:

- Operating lease: Deposit between 0-20% and a lease term between 1-6 years with a predetermined residual value. With this lease terms, VAT is 100% tax deductible and taxdeductions made monthly.

- Capital rent: Deposit between 0-20% and a lease term between 1-6 years with no residual value. With this lease terms, the VAT is a 100% tax deductible and tax deduction will take place immediately after purchase. This lease form, we believe is by far the most favorable for a new company when the VAT is refunded at one point. (Can be tentatively used to pay the lease fee, perhaps for 1 year). If you want to use your Estonian company as a supplier of car (s) to other companys, or to you privately, so must your Estonian company be able to show sales and profit. This is to the Estonian finance company that shall grant the lease with your estonian company. If your Estonian company has no sales or profit it may work out with a so-called "guaranty of payment" from other company or from yourself.

Other

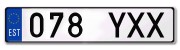

Cars your Estonian company buy or leases will have Estonian license plates with the EU flag.

- Estonian cars pay no road tax.

- Estonian cars do not have any fuel benefit tax.

- Estonian cars do not pay tolls ("congestion tax") in most countrys, where foreign registered vehicles are excluded.

Transportstyrelsen Stockholm

Transportstyrelsen Stockholm

Transportstyrelsen Göteborg

Transportstyrelsen Göteborg

- Insurance takes place in estonian insurance company such as IF, BTA, SEESAM or similar.

Estland

Estland

- Fuel cards for use in EU countries is sought from Statoil in Estonia.

Estland

Estland

- Of course you can also use your MasterCard, included in our packages, for fuel payments.

Warranty service and warranty repairs can be performed without charge at work shops throughout Europe as new Estonian cars are delivered with a Euro warranty.

Other services and repairs, you pay can with your company's MasterCard, which is part of our packages, or ask the shop billing to your Estonian company. We at myCompany can help you with contacts with car dealers, leasing companies, insurance companies and fuel companies. See our page "Prices - Other services".